Does digital currency have staying power?

Bitcoin is a form of electronic money that is not controlled by a person or institution.

Bitcoin has leapt onto the global stage

with a bang — and a crash. The digital money has already plunged from a high of

$260 in April to today’s value of about $92

Still,

Bitcoins, used to purchase goods online or transfer money to other

people, have steadily gained traction since they were invented in Japan

in 2009. Germany has Bitcoin marketplaces where holders can exchange the

currency. Designed to be a global currency, Bitcoin is also gaining

popularity in countries like Argentina and Kenya, amid worries about

local currency devaluation. Merchants, such as online dating site

OkCupid, are slowly starting to accept the digital money for goods and

services.

On Monday, Tyler and Cameron Winklevoss, known for their

legal dispute with Facebook Inc’s Mark Zuckerberg over the origin of

the social networking site,

unveiled plans

to offer shares of a Bitcoin trust — designed to operate like an

exchange-traded fund — to the public. According to an initial public

offering filing in the United States, the shares would allow investors

to “gain exposure to Bitcoins with minimal credit risk.”

Despite

the hoopla, Bitcoin is still a niche digital currency. It faces numerous

challenges on the road to wide-spread acceptance, including volatile

price spikes and daily volume surges that point to rampant speculation.

Also hindering growth: even sophisticated financial thinkers have

trouble understanding how it works.

So far, global adoption is

still tiny. Less than 1% of the world’s population uses Bitcoin

actively, according to estimates, though use is accelerating in the US

and parts of Europe.

Bitcoins are so volatile that owners must either spend them immediately, before they lose value, or hold them as investments.

The

next 24 months will be crucial to whether the currency will survive and

grow, say some experts. Though venture capitalists and technology

start-ups are rushing to solve concerns around Bitcoin, any significant

expansion is still uncertain given recent market fluctuations. Long-term

investors may walk away if volatility continues. Much more likely,

Bitcoin may become one digital currency among many others coming to

market.

“Even if Bitcoin doesn’t survive, cypto-currencies will

,” said California-based Andreas Antonopoulos, who advises organisations on emerging technologies and trends.

Origins

Bitcoin

is a form of electronic money that is not controlled by a person or

institution. New units are mined by programs that crack complex

mathematical problems and release new blocks of coins, though release is

limited to only 21 million virtual coins. Only 25 Bitcoins every 10

minutes can be created to control inflation. There are currently about

11.3 million in circulation.

The limited supply makes them like

digital gold, said Charles Hoskinson, founder of the Bitcoin Education

Project. To buy Bitcoin, most people go to Japan-based Mt.Gox, which

accepts 17 currencies. Fees are less than .60%.

Ease of use

depends on where you live. Adoption is ramping up with small merchants

in the US, Canada and parts of Europe, say experts. New trading

platforms like Russia-based Bitc-e.com, which also accepts other

alternative currencies like Webcreds.com, are even popping up.

France recently launched its Bitcoin Central exchange, too.

“Europe is a bit ahead of the US,” said Jonathan Waller, who runs a Bitcoin meet-up in Tokyo.

Uphill climb

Despite

this frenzied activity, Bitcoin faces an uphill climb. Its greatest

strength — sitting outside the global financial system — is also a

weakness. Few retailers accept the currency, though more, like the San

Francisco-based social news site Reddit and even US-based blogging

platform Wordpress, are accepting it. Rigorous control of new Bitcoin

makes expanding usage beyond a cult currency difficult.

The

biggest challenge might be volatility. As little as $3 million injected

into Mt.Gox can spike prices, say experts. In April, Bitcoin plummeted

$130 in a day, from a high of $260.

This volatility is catnip for speculators, who seek to profit from sudden price fluctuations.

Bitcoin’s

main problem is that value is based on whatever the next guy will pay,

said Brian Riley, a senior research analyst at the Boston-based research

and advisory firm CEB TowerGroup. “This makes them a speculative

currency,” he said.

“Speculators are making a mess of Bitcoin,”

said Antonopoulos. When traders jump in and out of the currency, it adds

to volume spikes.

There are currently 182 global currencies, said Riley.

“Why do we need another one?” he said.

Bitcoins

are so volatile that owners must either spend them immediately, before

they lose value, or hold them as investments. Turning cash into Bitcoins

can take days. Many people rely on cumbersome in-person Bitcoin

exchanges facilitated by Bitcoin web sites such as localBitcoins.com

, where people meet and exchange currency.

For these reasons, investors and consumers should not put more than 5% of their money into the currency, added Waller.

“Bitcoins are one big monetary experiment,” said Hoskinson.

Easing concerns

There

is a chance that these Bitcoin choke points will be solved by an influx

of new technology. In the US, a flurry of well-known venture

capitalists such as New York City tech wizard Fred Wilson, an early

investor in Tumblr and Foursquare, are spearheading Bitcoin startups.

The aim: developing better e-wallets, payment systems and even automatic

teller machines (ATMs), where you can exchange cash for Bitcoin.

Dozens of startups in California’s Silicon Valley are also attacking Bitcoin distribution problems, said Antonopoulos.

“Lots of venture capitalists are pouring money into Bitcoin without understanding them,” he added.

History

is rife with examples of early movers — Myspace is one — that ended up

in technology graveyards due to stronger competitors, though. And

currently, at least one dozen virtual currencies like litecoin and

ripple are vying for a piece of the digital currency market.

These

new currencies aren’t tough competitors, said Waller, though there’s

still a real risk that Bitcoin won’t survive this onslaught.

Jeff Bezos' purchase of the Washington Post is not the craziest thing he has put his money into.

Jeff Bezos' purchase of the Washington Post is not the craziest thing he has put his money into. It looks like the Rolling Stones are indeed on a roll with touring this year, commanding almost $8 million so far, according to

It looks like the Rolling Stones are indeed on a roll with touring this year, commanding almost $8 million so far, according to According to Nielsen SoundScan, Justin Timberlake's "The 20/20 Experience" is t

According to Nielsen SoundScan, Justin Timberlake's "The 20/20 Experience" is t They won't have to

shop there anymore, but according to Billboard Macklemore and Ryan

Lewis's "Thrift Shop" is the top-selling digital song for the first half

of 2013 with more than 5.5 million sold.

They won't have to

shop there anymore, but according to Billboard Macklemore and Ryan

Lewis's "Thrift Shop" is the top-selling digital song for the first half

of 2013 with more than 5.5 million sold.

Blake Shelton's

"Based on a True Story" is so far taking the country music crown for top

selling album of 2013, with more than 700,000 sold.

Blake Shelton's

"Based on a True Story" is so far taking the country music crown for top

selling album of 2013, with more than 700,000 sold.

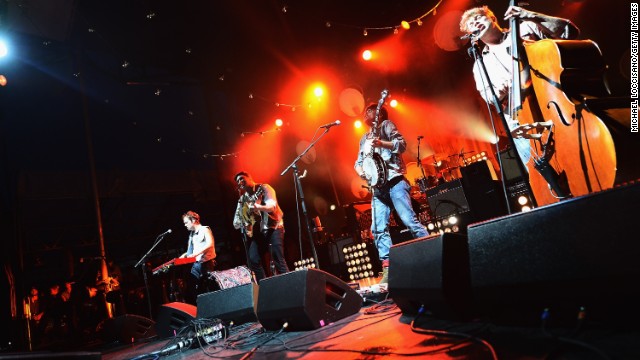

"Babel" by Mumford & Sons is the top selling rock album for the first half of 2013, with more than 800,000 sales.

"Babel" by Mumford & Sons is the top selling rock album for the first half of 2013, with more than 800,000 sales.

Daft Punk's "Random Access Memories" is the top dance/electronic album with more than 600,00 sold.

Daft Punk's "Random Access Memories" is the top dance/electronic album with more than 600,00 sold.

Box Office Mojo reports that "Iron Man 3" has puled in more than $400 million.

Box Office Mojo reports that "Iron Man 3" has puled in more than $400 million.

Mark Harmon, Sean

Murray, Michael Weatherly and Cote de Pablo appear in an episode of CBS'

"NCIS." According to Nielsen data, the show is tops for the 2012 to

2013 broadcast TV season, with a ranking of 14.2 among households.

Mark Harmon, Sean

Murray, Michael Weatherly and Cote de Pablo appear in an episode of CBS'

"NCIS." According to Nielsen data, the show is tops for the 2012 to

2013 broadcast TV season, with a ranking of 14.2 among households.

A&E has struck ratings gold with its reality show "Duck Dynasty." It's tops for cable original programing.

A&E has struck ratings gold with its reality show "Duck Dynasty." It's tops for cable original programing.